Nigeria will probably need to weaken the naira further following its devaluation last week, even as the central bank bulked global trends by holding rates on Tuesday to avert further depreciation.

With the decision to hold its benchmark rate at 13.50%, the central bank aims to avoid putting further pressure on the local unit after devaluing the exchange rate used by foreign bond and stock investors, which had been largely pegged since 2017, by about 4% to 380 per dollar.

“There was a need to be cautious in loosening, given the fact that it will exacerbate an already worsening inflationary condition, resulting in massive pressure on reserves and the exchange rate,” Governor Godwin Emefiele said during monetary policy decision in the capital, Abuja. There is need to address “unfavorable macro economic developments, rein in inflation, –check capital outflows, support external reserves and ensure foreign exchange market stability,” he said.

Other major oil currencies have fallen much more this month following the plunge in Brent crude prices to less than $30 a barrel. Russia’s ruble is down by 15% and Colombia’s peso by 14%.

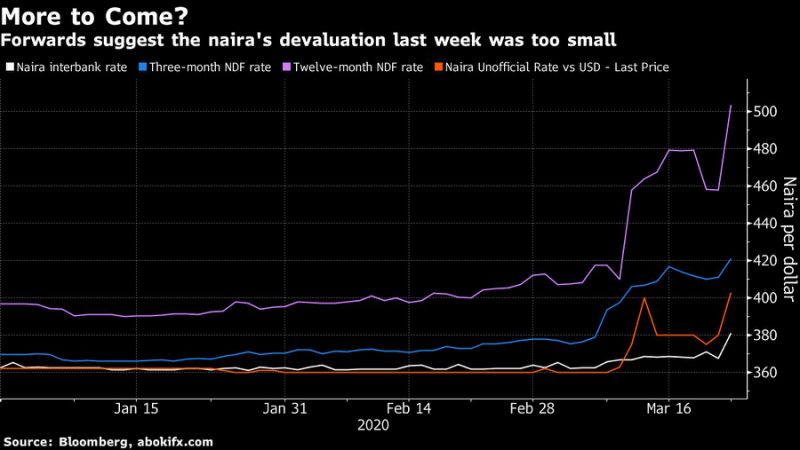

The derivative and black markets suggest the naira is still under plenty of strain. The price of three-month non-deliverable forward contracts has surged to 421 naira per dollar, signaling traders see another 10% devaluation in that period. One-year NDFs rose above 500 for the first time on Monday. The black-market rate has weakened to 403 from 380 this week, according to abokifx.com, a Lagos-based website.

“While it’s commendable that they’ve weakened the currency, it falls short of our fair value estimate of 410,” Yvonne Mhango, a sub-Saharan Africa economist at Renaissance Capital in Johannesburg, said. “It would be positive if the central bank were to also introduce a flexible foreign exchange rate, and move away from near peg.”

Oil accounts for about half of government revenue and 90% of exports. Foreign reserves have decreased 20% since July to $35.9 billion. Nigeria started offering crude at an unusually low discount from next month in an effort to undercut its rivals.

“Further devaluation is likely, considering oil-exporter peer devaluation and an overvalued starting point,” Hasnain Malik, Dubai-based head of strategy at Tellimer, said on Sunday.

Nigeria has long kept a tight grip on the naira and back in 2014-16 — when, like this month, oil prices crashed — its refusal to let it drop caused dire shortages of foreign currency that hammered the economy.

As well as weakening the investor rate on Friday, Emefiele also devalued the naira’s official rate — which is mostly inaccessible except to government departments and importers of goods such as fuel — to 360 from 306 per dollar.

The partial convergence of the various naira rates will ease pressures on Nigeria’s balance of payments and budget, Chapel Hill Denham analysts including Tajudeen Ibrahim and Omotola Abimbola, both based in Lagos, wrote in a research note. But “a more significant devaluation may be required,” they said.

Nigeria could tighten capital controls to support the naira, though it will be forced into another devaluation by the third quarter, according to Alexandre Raymakers, an Africa analyst at Verisk Maplecroft, a U.K.-based risk consultancy.

Standard Bank Group Ltd. economists Phumelele Mbiyo and Gbolahan Taiwo, based in Johannesburg, said Monday they expect the naira to trade between 385 and 390 by the end of the year. But there’s a “significant” chance it’ll depreciate more than that because of oil prices and the coronavirus, they said. A central bank spokesperson didn’t immediately respond to a request for comment.

A weaker naira would boost government revenues by allowing dollar earnings from oil to be converted at a higher rate. In contrast, it would increase the Nigeria’s foreign debts in local-currency terms.

(Updates with Nigeria’s central bank governor’s comments in the first three paragraphs)

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.